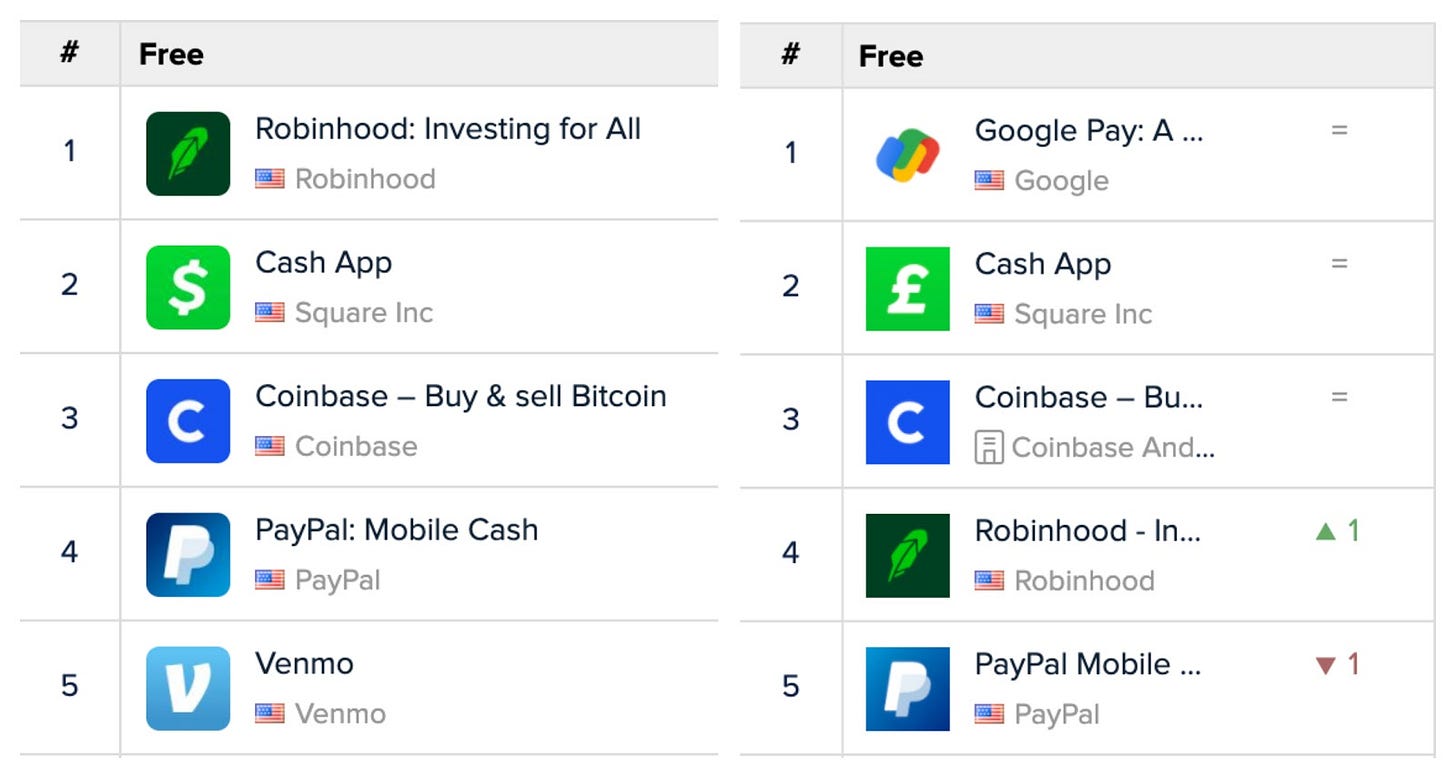

You Can Buy Bitcoin on 4 of the Top 5 Finance Apps

Fintech is taking over the mobile world. But the apps are struggling to differentiate from competitors. Their new focus? Bitcoin.

Issue #3. We’re here.

Wanted to thank everyone for the messages over the last week. Still can’t believe there are over 530 people subscribed. Thank you! If you have any thoughts or feedback, feel free to tweet at @MarketMix_. You can also DM me at @bradmichelson.

And, of course, if you like what you’re reading, please share with your friends.

You can buy bitcoin on four of the top 5 finance apps on the App Store and Google Play Store. How cool is that?

Robinhood, CashApp, and PayPal made cryptocurrency trading a “me too” feature among fintech companies in 2020. By the end of 2021, we’ll see Venmo added to this list, as well.

If you rewind time back to 2019, cryptocurrency was still largely seen as a niche interest to the wider consumer finance market. But 2020 was a big year for legitimizing digital currencies.

Most people don’t realize this but major banks and financial institutions have been involved in the blockchain space since and before the 2017 bull run. At my first crypto job in 2018, our company would do Lunch and Learns at Citi Bank for their employees. We were far from the only crypto startup doing educational talks to bankers.

In the years since, institutional interest in crypto has only expanded. In 2020 we saw…

Fidelity allowed its institutional customers to pledge Bitcoin as collateral against cash loans in a partnership with BlockFi

JPMorgan’s own cryptocurrency (JPM Coin) tested for commercial transactions

Leading crypto lending firm, Genesis issued $5.2 billion worth of new loans in Q3 (more than double its previous record of $2.2 billion in Q2). That’s just one of many firms in the crypto lending space.

The OCC officially ruled that federally regulated banks can use stablecoins to conduct payments and other activities

Public companies like Square and MicroStrategy hold bitcoin as a reserve asset in their treasury (full list)

And, of course, we saw some of the biggest finance apps in the US enable crypto trading for their users.

But, wait, financial service companies are traditionally overly sensitive to legal and compliance issues. Why would they open themselves to those risks?

To grow their customer base, of course.

The context: they’re all in a race to IPO (if they haven’t already). This requires them to show continued user growth.

Over the last couple years, all of the fintech apps have created more or less identical offerings. They all have great mobile apps with cutting-edge user experience and design. They all offer investment and interest-bearing accounts. Most of them are offering debit/credit cards now, too. As a result, they’re all fighting for the same limited customer pool.

The crypto community is an obvious target for these products. The customer profiles are virtually the same.

Let’s think about it this way: who are crypto investors?

Early Adopters: trying out the newest thing

Investors: knowledgeable on personal financial

Communicative: If they like something, people are going to hear about it

The venn diagram of fintech users and crypto investors is just a circle. The fun part is that those two communities are merging as we speak.

The more fintech apps adopt crypto, the more general-public users of those apps will try investing in crypto. Similarly, the more blockchain technology introduces efficiencies for consumer finance, the more fintech app customers will try using cryptocurrencies for things like stores of value and P2P payments (see: stablecoins use case).

What’s already clear is that 2021 is pacing to be the biggest-ever year for the crypto industry, and the major fintech apps will be a big part of that. This year we will also see the first crypto companies launch public offerings. Did you notice that Coinbase is the third most downloaded finance app right now? You can read about their S-1 filing here.

I don’t know about you, but I’m getting pretty excited.

Thanks for reading! Don’t forget to share Market Mix with your friends. 🔺